A straightforward breakdown of cryptos.

Disclaimer:

I am not your financial advisor (yet).

Do not take anything on this page as financial advice, EVER.

DO YOUR OWN RESEARCH!

Consult a professional investment advisor before making any investment decisions!

My articles/videos are only for sharing my opinions and educational purposes 😉

So, Exactly What Is Cryptocurrency?

I’ll give you the most straightforward (but still correct) explanation.

Cryptocurrency is basically the virtual or digital equivalent of the physical money we interact with daily.

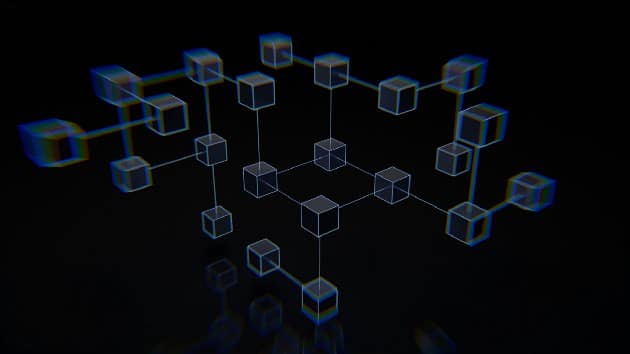

But just to add more to that, while cash relies on banks or financial organizations to record transactions and foster trust and security in the overall system, crypto uses a technology known as blockchain to act as both a public ledger or record of transactions and a security system.

Don’t worry.

I will be talking some more about blockchain technology in a short while.

How Many Cryptocurrencies Are There?

You have probably heard about Bitcoin and Ether, the two largest cryptocurrencies, but there are actually over 18,000 cryptocurrencies as of posting this article.

Other examples of cryptocurrencies include Dogecoin, Shiba Inu, Cardano, Baby Doge, Solana, Litecoin, and Polkadot.

Let’s Now Move on to the Different Types of Cryptocurrencies

So, generally speaking, there are two types of cryptocurrencies, namely coins and tokens.

On the one hand, coins refer to those cryptocurrencies with their own blockchain, for example, Bitcoin, the native coin for the Bitcoin blockchain network, Ether, the native coin for the Ethereum blockchain, and BNB, the native coin of the Binance blockchain.

On the other hand, tokens are the complete opposite in that these are cryptocurrencies that do not have their own blockchain.

Rather, they operate on another blockchain, and often the Ethereum blockchain, instead of their own, and examples of tokens include Tether and Shiba Inu.

Why Is Crypto Becoming More and More Important?

The number one reason I feel cryptocurrencies are increasingly popular is blockchain technology, and let me tell you why.

Thanks to blockchain, cryptocurrencies are decentralized mediums of exchange, which essentially means that every cryptocurrency transaction is recorded on a ledger that is copied and distributed for easy access by any person on the cryptocurrency network.

I want to stress this again.

No one person keeps the transactions ledger; it is distributed to everyone on the blockchain network.

Now, for a short analogy of what a blockchain actually looks like.

Think of blockchain as an enormous digital MS Excel sheet or spreadsheet that everyone can see, and once information is added there, it cannot be changed.

For that reason, if I, Mandy C, sent you one Bitcoin, the whole Bitcoin digital spreadsheet or blockchain gets updated with this information. So, it’ll say something like Mandy C just sent “You” one bitcoin.

This information lives on the Bitcoin blockchain or spreadsheet forever and cannot be changed.

If one computer gets hacked or knocked down, other computers still keep the blockchain running along with the information within it.

Another reason I feel that cryptocurrencies are increasingly being embraced is because they eliminate intermediaries from value transactions.

And again, I must say that this is mainly because blockchain technology locks out banks and other financial institutions from having to act as a go-between between two transacting parties.

Instead, people transact with each other directly, everyone on the blockchain network verifies their transactions, and records are also spread out across the same network.

With that said, some other reasons behind the popularity of cryptocurrencies are:

- No spending limits; and

- The absence of interest rates or exchange rates.

Now, Lest I Forget, Let Me Tell You About the Dark Sides of Crypto

The number one downside of crypto is volatility in that prices tend to swing up and down, sometimes even on the whims of people like Mr. Elon Musk.

Whether from online articles or the good old TV, news can also trigger changes in crypto prices, sometimes quite significantly.

Another issue with crypto is that it is not accepted globally, and countries like China have even downright banned them.

Last but not least, cryptocurrencies pose a genuine environmental concern because they take up a lot of electricity.

Specifically, Bitcoin and other proof-of-work cryptocurrencies require large amounts of energy to create or mine.

Let me give you the figures to give a better perspective.

- Bitcoin uses around 136.38 Terawatt-hours of electricity yearly. That’s more than the Netherlands, Argentina, or the United Arab Emirates consumes over the same duration.

- Ethereum uses about 112.6 Terawatt-hours of electricity per year, which is more power than the Philippines or Belgium require.

What Affects Crypto Value?

Cryptocurrency value and to a huge extent prices are actually determined by what they do.

For example, Bitcoin has value because it has an economic profile similar to gold.

It has a maximum supply, and only small amounts are mined each day.

What makes it even more valuable is that the amount of Bitcoin distributed to miners is halved every four years.

Ether has value because of the utility it provides.

That basically boils down to the fact that many tokens, as well as decentralized applications and websites, can be built on the Ethereum blockchain.

And since all transactions related to creating and moving these tokens and interacting with these decentralized applications require gas fees paid in Ether, this coin’s value is realized.

As a Bonus — My Tips for Investing in Crypto

First, research the cryptocurrency you want to invest in.

What does it do?

What problem is it solving?

Is the underlying technology good?

Who is the team behind it?

Be sure to find out.

Yes, it’s pretty much the same due diligence you would do when determining what stocks, properties, ETFs, etc., to invest in.

Another tip is not to follow the hype, but instead, look for substance.

Is the coin or token being used to build applications?

Is actual adoption happening, or is there any development?

You want to invest in cryptos that answer “yes” to these questions because they tend to witness organic growth over the long term compared to cryptos like Dogecoin, which thrives on media attention, hype, or tweets from crypto influencers, e.g., Mr. Elon (again).

Learn the difference between gambling with crypto and investing in it. The latter is more strategic, and that’s what you want.

I hope you got some valuable pointers from this article. If you want to learn more about how to reclaim your emotional, spiritual and financial sovereignty, be sure to check out my pages / YouTube channel.

Recent Comments