And my FREE shares for you.

As you might have noticed already, we have technically entered a recession.

It may give you intense anxiety, or excitement to search for alphas that are now undervalued.

In order to diversify my risk and identify new opportunities, besides exchange-traded funds (ETFs) and cryptocurrencies, I have been exploring other alternative investments, and one that interests me is…

Private Equity.

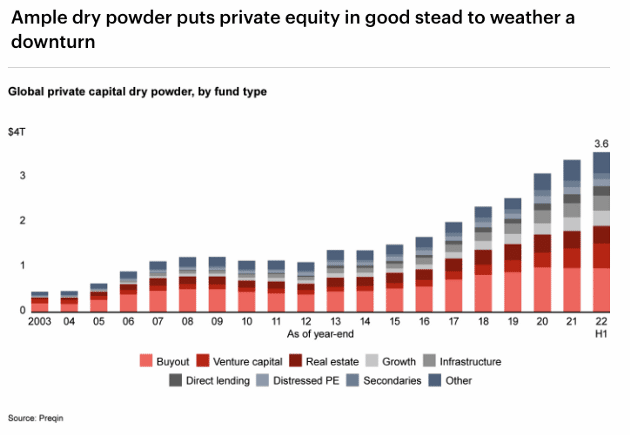

According to the latest midyear private equity report by Bain Consulting, PE investors earn superior internal rates of return in years following recessions.

Interesting.

I decided to take some time to see if it suits me and how I could do that with minimal risk. (Actually, I mean, with minimal investment.)

And I want to share my findings with you.

So, let me quickly walk you through 3 reasons for investing in private equity and if you are game, how you can get started with (drum roll please…) less than $2.

First, what’s in it for us?

1. Portfolio diversification

The first reason is simple: private equity is an alternative investment, meaning it can diversify your investments beyond public equities such as stocks and the like.

And of course, if you invest in multiple private companies, you further diversify your risk.

2. Exposure to hidden gems

Private equity also exposes you to smaller, less crowded companies with great upside potential.

You will be open to a hidden world of growth companies that most conventional investors shy away from.

3. Long-term history of out-performance

Private equity has demonstrated superior performance over the long term compared to public equities.

Studies show that this has been the case in America in the last two decades and in Europe.

I do want you to know that private equity can carry significant risk, especially if the investment minimum is high because that can magnify gains but also losses.

Even so, it still has the potential to yield better returns than conventional investments like stocks and bonds over a long time.

And interestingly, after an inflation recession, because these cycles are usually relatively short-lived.

So if you are game, how to get started with minimal risk?

For the longest time, venture investing has long been a reserve of individuals with big money, and most of us are kept outsiders.

Ummm.

I am happy that someone is changing the game because, in my dream world, everyone should have the same access to information and opportunities.

Ok. Drum roll again please.

Let me introduce Raison.

Btw, a late venture is a startup with over a $1 billion valuation.

You can invest in one on the Raison platform by signing up with this affiliate link, to earn your €5 FREE shares on Raison now!

That way, you not only get an opportunity to invest in the next big tech startup, but will also earn a €5.00 gift.

That translates to 1 to 2 FREE fractional shares.

Why can you invest with less than $2?

Because Raison allows you to invest in these late ventures from as little as 0.1 fraction of a share.

To clarify, fractional shares are small pieces or fractions of a share.

This feature stands out because it allows me to get a feel of investing in venture deals without needing to invest hundreds of thousands of dollars.

I love that I can feel like a venture capitalist, with just $2.

And because I am investing more than $2, I know I am a rich venture capitalist.

What are the steps?

There are only 3 steps:

- Get onboard;

- Choose the company(ies) you want to invest in; and

- Wait for the exit.

Let’s talk about the last step of exiting.

You exit when the company you have invested in goes public after its lock-up period ends.

Raison will then sell the company’s shares on the public market and distribute returns to you.

You will receive a payment equal to the number of units you hold multiplied by the new share price.

Caution: The lock-up period

I want to remind you that because you can only sell your shares after the lock-up period, which usually ranges from 90 to 180 days, you may not be able to cash out when the shares are at their highest prices.

And that’s the point — Invest in a company you truly believe in, instead of getting swept up by the investment hype.

What I think about Raison

1. User-friendly interface

One of the things I like about Raison is its easy-to-navigate interface — there are not too many buttons and all of them are pretty straightforward. I knew what I could do there the first time I used it. On the app, you can easily access the startup you like, review its pitch and terms, and invest.

2. Top up with crypto and waive that fee

As a user of cryptocurrencies, I am happy that I can use cryptos to top up my account on Raison.

Raison allows me to move my crypto assets to its platform for trading so I can skip credit card transaction or bank transfer fees.

If you don’t have a crypto wallet, it’s fine too!

Raison offers a wide range of deposit and withdrawal options, including SEPA, SWIFT, Visa, and MasterCard.

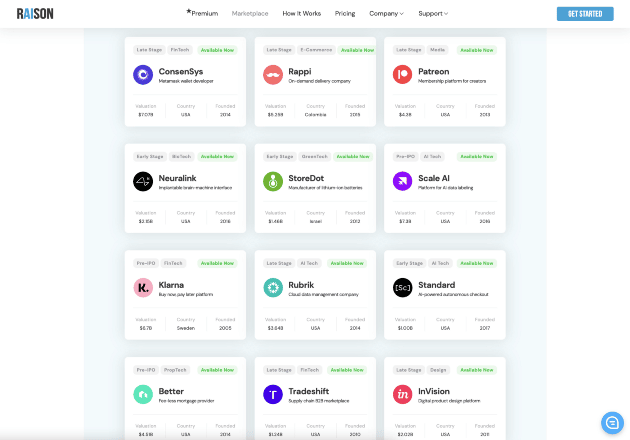

3. Wide-range of vetted companies

With the Raison app, I can invest in the best tech unicorns as recommended by an experts’ analytics team at the company.

In fact, the vetting team consists of at least 30 specialists, meaning I only get to access top-tier deals.

As of posting this video, some of the startups I can invest in, thanks to Raison, include:

Just to mention, these and other startups on the Raison marketplace are assessed based on relevant data and financials, among other things.

4. Cool technology

Because I am not a tech person, all I can tell you is this: Raison leverages blockchain technology to integrate fractional shares and this is the world’s first legal structure for secure venture investments available for everyone.

To provide shares on the Raison marketplace, the team creates tiny fractions of its specialized fund and deploys smart contracts to list units of a specific company.

5. Knowing my money is in good hands

Raison is backed by Raison Asset Management, which has 7 years of expertise and over $50M of VC deals.

Raison Asset Management is a Registered Investment Adviser (RIA) regulated by the U.S. Securities and Exchange Commission.

It also meets the requirements of the European Securities and Markets Authority (ESMA) and is a member of FINRA.

All these licenses are accessible on their website.

6. Transparency and accessible team

I have been playing with my Raison app for a while.

I like that they are very transparent with their operations.

I can easily find all the documents for each investment before I make the investment.

If you are interested in learning more about Raison and claim your FREE fractional shares, sign up with my affiliate link.

Raison team also told me that they are always to chat and any questions you may have.

I do want to end this article by reminding you that: personal finance, and of course investment, is a very personal thing, so do your own due diligence before investing in any financial products.

However, there is always one best investment you can make and that is — yourself.

The market can crash on any day but your ability to make money will only grow, as long as you make an effort to learn.

And financial education is one of those ways to help you make more money.

Btw, I am launching my own NFT collection called Rich Goddess, which you may want to check out because our WL is half-filled already! 😉

Also, if you want to learn more about how to reclaim your financial power, be sure to check out my page / YouTube channel.

Recent Comments